For instance, maybe you’ve been wanting to up your IRA contributions. You’ll have to figure out which of your expenses are eating up too much of your budget, and where you may want to cut back to make sure you aren’t going into debt to afford your lifestyle.Įven if you aren’t overspending, though, it’s still worth taking a look at your expense categories to figure out if you’re happy with where your money is going compared with the goals you have for you or your family. Is this number higher than what you added up as your actual discretionary spending? Then congratulations - you’re living within your means!īut if your actual discretionary spending is higher than what the math says it should be, it means you’ve got some work to do. What’s left is how much you have available for discretionary spending. Take your total monthly take-home pay and subtract your fixed expenses (including non-monthly costs) and your goal funding. Or pick a month that you’d consider a typical month as far as your discretionary spending goes, and use that figure.

If you’re not sure what this figure should be, look at how much you’ve spent over the past three months and use that to get a clearer picture. It’s basically extra money that you can use for things like going out for a nice dinner with friends or taking a last-minute vacation over a long weekend. ADD UP YOUR DISCRETIONARY SPENDINGĭiscretionary spending is money that you can spend on whatever you like that isn’t already a fixed or necessary expense. Each month, the payments that you make to these goals will get you closer to financial security by helping you pay down any debts you owe and save so that you’ll be able to do the things that are important to you like help fund your child’s education, take that dream vacation and retire comfortably someday. This category includes what you’re currently putting toward savings goals, paying down debt or any other longer-term financial goal. Then take that total and divide by 12: This is how much you should put away each month in a separate savings account so that when those bills roll around, you know you’ve got the cash to pay for them. What you spend on gifts for holidays, weddings, birthdays, etc., can also fit in this category.

Monthly expenses list registration#

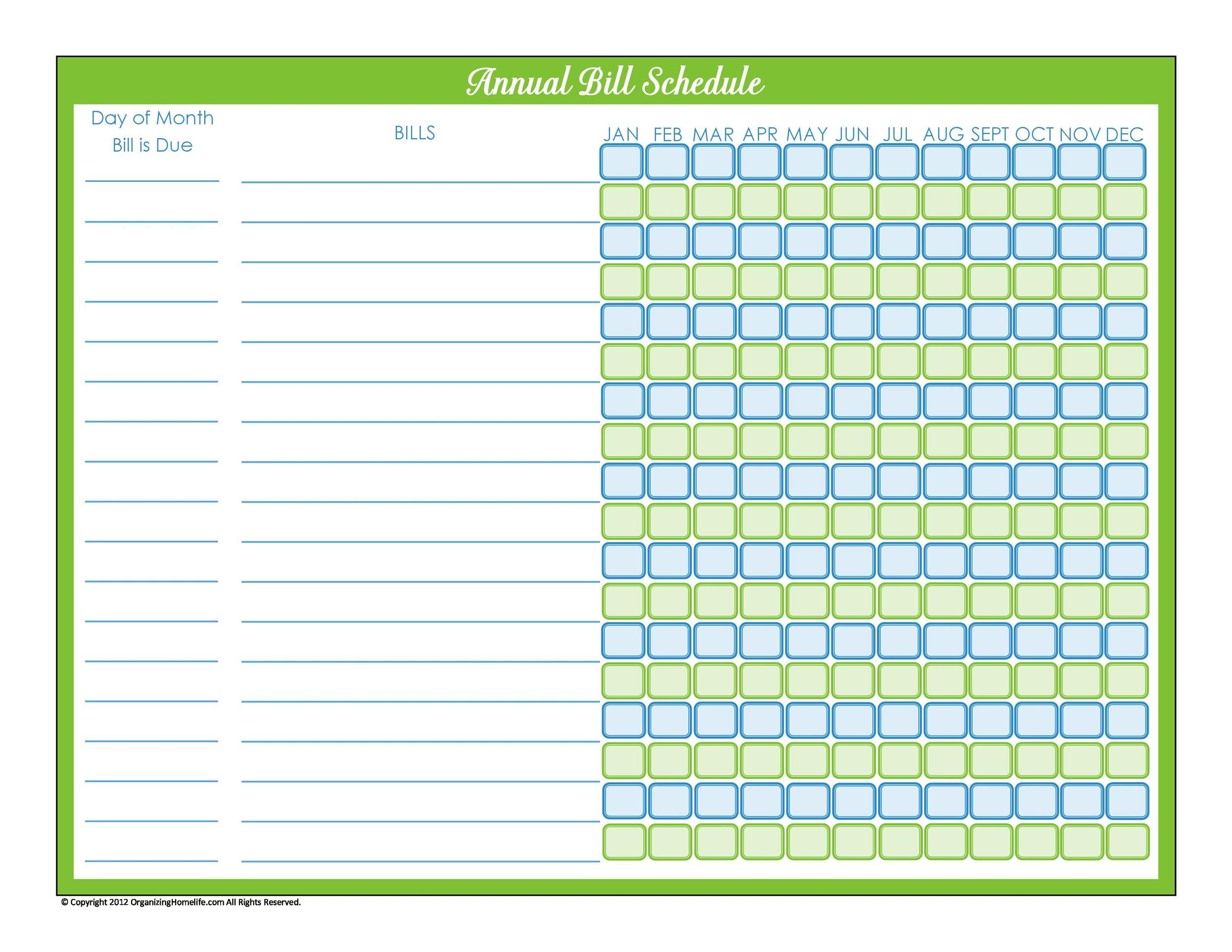

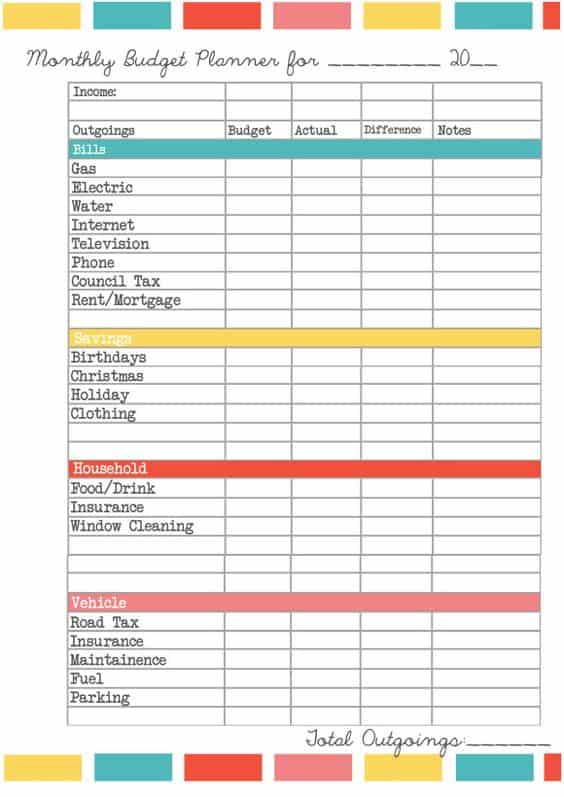

So how do you do that? Add up what you spend every year on things like quarterly taxes, auto registration fees, annual insurance premiums, school tuition and travel. Because these types of costs can fall off your radar until right before they’re due, it’s important to account for them in your budget. One part of a budget that individuals typically don’t account for are irregular, non-monthly payments. ADD UP WHAT YOU SPEND ON NON-MONTHLY COSTS These are basically the non-negotiable expenses that keep your life running. This can also include things like what you spend to feed your family each month. They include essential costs that don’t already come out of your paycheck, like your mortgage or rent, car payment, utilities, cell phone bill or day care. These are the bills and expenses that you plan for - the things you need on a regular basis. If your side jobs don’t deduct taxes from your paychecks, then only include what you keep after you’ve set aside an amount to pay taxes.

Include not only income from a regular paycheck, but also the take-home pay you earn from a side gig or part-time job. TOTAL YOUR MONTHLY TAKE-HOME PAYįirst things first: How much money do you have to work with? Add up what you earn each month after taxes and payroll deductions, because you want to work from money that’s actually being deposited into your bank account. If you’ve never created a budget before - or simply need a fresh start on one you’ve already got - we’re here to help. Plus, a budget will help ensure you’re able to cover your day-to-day expenses while still saving for future goals like retirement or your kids’ college. It enables you to keep track of the money that’s going in and out of your bank account. That’s where creating a monthly budget comes in. When your paycheck hits, there’s that little burst of happiness that comes from having a well-padded bank account.īut then the end of the month rolls around - and you may go from flush to flustered. Disability Insurance Calculator Money Parachute icon.Environmental, Social & Governance Report.

0 kommentar(er)

0 kommentar(er)